What is Payroll Giving?

Payroll Giving is a scheme run through HMRC and administered by Charities Trust. It allows employees to make simple,

tax

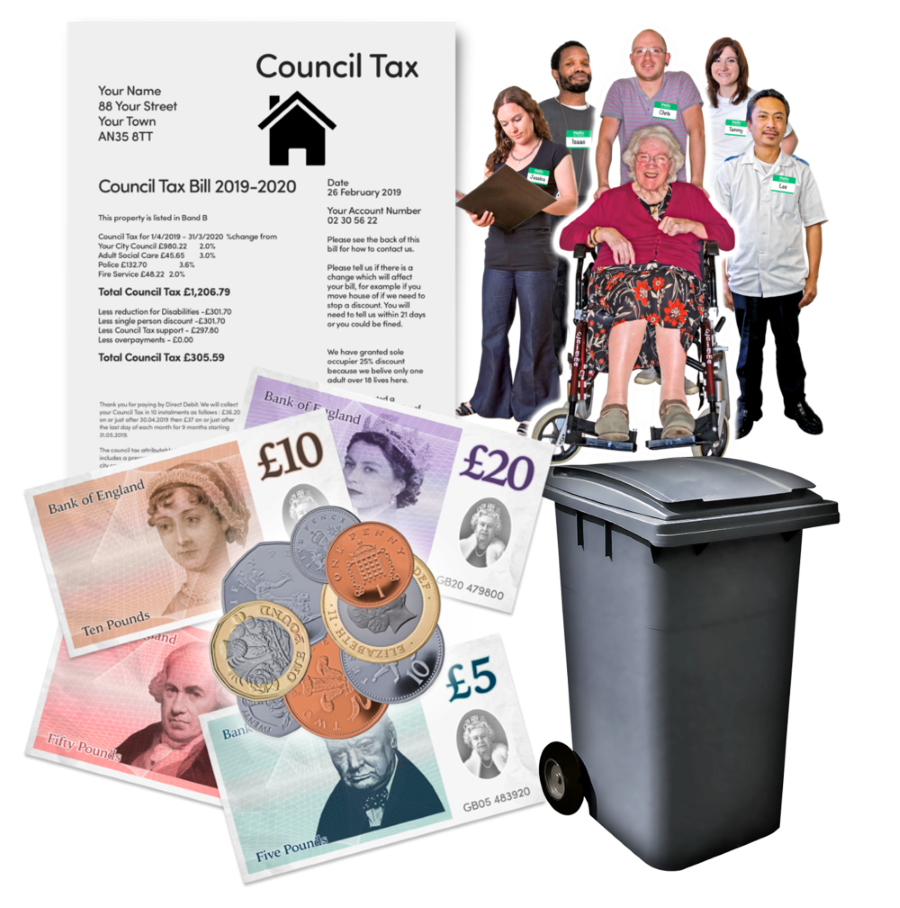

Tax is the money that pays for things like schools, hospitals and the police. There are different types of taxes like

income tax

Tax is the money that pays for things like schools, hospitals and the police. There are different types of taxes like

income tax

Income tax is the money that is taken out of the money you earn every month. It helps to pay for things we all need like hospitals and schools.

,

VAT

Income tax is the money that is taken out of the money you earn every month. It helps to pay for things we all need like hospitals and schools.

,

VAT

VAT is also called Value Added Tax. VAT is the extra money you pay when you buy things. The money goes to

the government

VAT is also called Value Added Tax. VAT is the extra money you pay when you buy things. The money goes to

the government

The Government are the people who run the country. The Government decide how much tax people should pay and how things like the National Health Service (NHS) should work.

to pay for things like schools and hospitals.

and

council tax

The Government are the people who run the country. The Government decide how much tax people should pay and how things like the National Health Service (NHS) should work.

to pay for things like schools and hospitals.

and

council tax

Council

Council

A council is also called a

local authority

A council is also called a

local authority

A local authority is also called a council. They are a group of people who make decisions about some of the things in the area where you live like schools,

social care

A local authority is also called a council. They are a group of people who make decisions about some of the things in the area where you live like schools,

social care

Social care means the services that give care and support to people who need it.

(support for people), parks and dustbin collection.

. They are a group of people who make decisions about some of the things in the area where you live. These include: schools, social care (support for people), parks and dustbin collection.

Tax is the money that people pay to the

council

Social care means the services that give care and support to people who need it.

(support for people), parks and dustbin collection.

. They are a group of people who make decisions about some of the things in the area where you live. These include: schools, social care (support for people), parks and dustbin collection.

Tax is the money that people pay to the

council

A council is also called a

local authority

A council is also called a

local authority

A local authority is also called a council. They are a group of people who make decisions about some of the things in the area where you live like schools,

social care

A local authority is also called a council. They are a group of people who make decisions about some of the things in the area where you live like schools,

social care

Social care means the services that give care and support to people who need it.

(support for people), parks and dustbin collection.

. They are a group of people who make decisions about some of the things in the area where you live. These include: schools, social care (support for people), parks and dustbin collection.

. It helps to pay for things like social care (support for people), parks and dustbin collection.

.

-effective donations to any UK charity.

Social care means the services that give care and support to people who need it.

(support for people), parks and dustbin collection.

. They are a group of people who make decisions about some of the things in the area where you live. These include: schools, social care (support for people), parks and dustbin collection.

. It helps to pay for things like social care (support for people), parks and dustbin collection.

.

-effective donations to any UK charity.

It's a simple and low maintenance way to give, all you need to do is complete our online form and we'll organise everything for you.

A Payroll Giving Agency will help your employer distribute donations, charging a small fee to cover their operating costs. Some employers pay this fee on your behalf and we receive your full donation. If your employer doesn't pay the fee (2% to 4%) it will be deducted from your donation before we receive it, still a favourable comparison against the cost of claiming Gift Aid on Direct Debit donations.

The amount we receive will appear on your

payslip

A payslip is a document that shows how much you have been paid and how much money was taken off to pay your taxes.

and all you have to do to stop or change your donation is notify your payroll department.

A payslip is a document that shows how much you have been paid and how much money was taken off to pay your taxes.

and all you have to do to stop or change your donation is notify your payroll department.

Setting up your regular donation couldn't be easier!

Simply complete our online form and we'll organise the rest.

Your donation is very important to us, as it helps people with a

learning disability

A learning disability is to do with the way someone's brain works. It makes it harder for someone to learn, understand or do things.

live the life they choose. If you'd like to receive updates on our work, we'll send them to you.

A learning disability is to do with the way someone's brain works. It makes it harder for someone to learn, understand or do things.

live the life they choose. If you'd like to receive updates on our work, we'll send them to you.

Did you know?

-

This long term source of regular income helps us budget and plan ahead

-

Your gift is taken before tax - so each £1 only costs 80p, the taxman pays the rest!

-

We don't have to claim tax back through Gift Aid, which saves on administration costs

What is it worth?

Payroll Giving is a valuable, long term source of regular income that helps us

budget

A budget is a plan where you look at how much money you have and how you will spend it.

and plan ahead more effectively, helping us provide support to people with a learning disability, their families and carers.

A budget is a plan where you look at how much money you have and how you will spend it.

and plan ahead more effectively, helping us provide support to people with a learning disability, their families and carers.

Donations are deducted before tax so each £1 you give, will only cost you 80p, and if you're a higher rate tax payer, it will only cost you 60p.

For example, a donation of £5 per month will cost the basic rate tax payer £4, and a higher rate tax payer £3 - the taxman pays the rest! Also, because your donation is taken straight from your gross (pre-tax) pay, there is no need for us to claim any tax back through Gift Aid, saving us additional admin costs.

What will we do with your gift?

Any gift you give through your payroll will go towards vital support for people with a learning disability, for instance:

£10 could help buy specialist equipment that will help a child with a learning disability to communicate in our nursery.

£20 could help pay for a one to one advice session for someone who is leaving college to inform them about

employment

Employment means having a job.

and support services available from Mencap.

Employment means having a job.

and support services available from Mencap.

£30 could pay for a

community

A community is the people and places in an area.

officer to talk to hospital about how they can improve the service for people with a learning disability.

A community is the people and places in an area.

officer to talk to hospital about how they can improve the service for people with a learning disability.

Where can I find out more?

If you'd like further information about how the scheme works you can phone 0845 077 0777 or email supportercare@mencap.org.uk.

You can also find more details from the Payroll Giving Centre and from HM Revenue & Customs.

Frequently Asked Questions (FAQ)

We've answered some of your FAQs around Payroll Giving.

Click on the questions below to reveal the answer.

How does Payroll Giving work?

It's very easy. Email us at supportercare@mencap.org.uk and we'll make sure that your company operates a scheme that allows you to give to us straight from your pay, and we'll notify your Payroll Department that you'd like to set up a regular donation to us in this way.

If your company doesn't operate the scheme, then we'll contact you to let you know.

How do I set it up?

Setting up your regular donation couldn't be easier! Simply complete our online form and we'll organise the rest.

Your donation is very important to us, as it helps people with a learning disability live the life they chose. If you'd like to receive updates on our work, we will send them to you.

Can I give to more than one charity?

Yes.

You can donate to as many charities as you like, as long as they are charities registered in the UK.

Is there a minimum donation?

No.

There is no upper or lower limit. However, we recommend that you give at least £2 per month.

When will my first donation be deducted?

Your first Payroll Giving contribution is made on your next pay day.

However, if you're signing up towards the end of the month (after your employer's payroll has been processed) your first contribution will be made the following pay day.

How is Payroll Giving different to donating via Direct Debit (and including Gift Aid)?

Payroll Giving is taken straight from your gross (pre-tax) pay, so there is no need for us to claim any tax back through Gift Aid, which saves us additional admin costs.

If you're a 40% or 45% taxpayer, Payroll Giving is the only way we can automatically receive all your tax on a donation.

Can I stop giving when I want?

Yes.

All you have to do to stop or change your donation is to directly notify your payroll department.

What happens to my Payroll Giving donation when I leave this job?

Your Payroll Giving donation automatically stops when you leave your job.

It's easy to start giving through the scheme again. Simply contact the payroll department at your new workplace.

Is there an administration fee?

Yes, but only a small one.

Your employer will use a Payroll Giving Agent (like a charity bank) to distribute donations that you and your colleagues make. The Payroll Giving Agents are charities that need to make a small charge to cover their operating costs. Some employers pay this fee on your behalf so we receive your full donation.

If your employer don't pay the fee, the Payroll Giving Agent will deduct it from your donation before passing it on to us. This will be between 2% and 4%. This compares favourably against the admin costs of claiming Gift Aid on a Direct Debit donation.

How do I know that you've received my donation?

Your donation is very important to us and we'll write to thank you.

We may also send you updates on our work, if you've indicated that you're happy to receive these. You'll know the deduction has started as it will appear on your payslip.

I pay the higher tax rate at 40% or 45%. How does this affect my donation?

You will receive tax relief at the highest rate of tax you pay.

Do I need to Gift Aid my donation?

Payroll Giving is taken straight from your gross (pre-tax) pay so there is no need for us to choose to claim the tax back through Gift Aid - saving us admin costs.

If you are a 40% or 45% taxpayer, Payroll Giving is the only way we can automatically receive all your tax on a donation.

Can I still give through my pension?

Yes.

If you receive an occupational

pension

A pension is money you get when you are older to pay for the things you need. You can pay money into your pension when you are working so there is more money for when you are older.

and your pension provider deducts tax through the PAYE system, you are still eligible for the scheme.

A pension is money you get when you are older to pay for the things you need. You can pay money into your pension when you are working so there is more money for when you are older.

and your pension provider deducts tax through the PAYE system, you are still eligible for the scheme.

Simply ask your occupational pension provider to make a donation from your pension before tax has been deducted.

What should I do if my employer doesn't currently have a scheme?

If you don't think that your employer has a Payroll Giving scheme, email us at supportercare@mencap.org.uk and we'll let you know.

If they don't, we may suggest to them that they introduce one.

How do I set it up?

Setting up your regular donation couldn't be easier! Simply complete our online form and we'll organise the rest.

Your donation is very important to us, as it helps people with a learning disability live the life they chose. If you'd like to receive updates on our work, we will send them to you.

If you'd like further information about how the scheme works you can phone 0845 077 0777 or email supportercare@mencap.org.uk.

Or, you can complete our contact form and a member of the team will get back to you.

You can also find more details from the Payroll Giving Centre and from HM Revenue & Customs.